- Published on

MEV and Block Building Part 1 - An Overview

- Authors

- Name

- merkle

- @merkle_mev

Introduction

Whether you are dipping your toes in the crypto industry, trading memecoins on DEXs, investing in crypto assets, or building a crypto startup like us at Merkle, the one thing we all have in common is that we generate transactions through our interactions with the blockchain. We should all be familiar by now that transactions are sent to the mempool, a distributed collection of pending transactions, from which miners/validators construct new blocks to be added to the ledger. Today however, Ethereum and certain other applicable chains operate with a much more complicated network of transaction flows to deliver and confirm transactions. This network is composed of many different entities with distinct responsibilities, created to improve the fairness and value for all participants of the chain.

But why do we need complex measures in the first place? While a permissionless and decentralized computer boasts a utopia of innovation for the good-intentioned, Ethereum is also a dark forest, where actors can be malicious and manipulate in order to serve their own interests. This concept is otherwise known as MEV. Thought leaders in the space have named the solution to this problem as the “Millennium Prize” of crypto. Like many others, we at Merkle have spent a lot of time understanding MEV and are building infrastructure to minimize its effects for crypto users.

In this blog post, we will learn more about MEV and how it has evolved over the years into what it looks like today. In subsequent posts in this blog series, we will dive into interesting areas of research in this space.

Wat MEV?

Miner extractable value (MEV) is a measure devised to study consensus security by modeling the profit a miner (or validator, sequencer, or other privileged protocol actor) can make through their ability to arbitrarily include, exclude, or re-order transactions from the blocks they produce. MEV includes both ‘conventional’ profits from transaction fees and block rewards, and ‘unconventional’ profits from transaction reordering, transaction insertion, and transaction censorship within the block a miner is producing. - Alex Obadia (Flashbots)

MEV is a broad formalization of any value an actor can extract for themselves using open or privileged information or responsibility. The most common forms of MEV through transaction reordering and/or transaction insertion are:

Frontrunning - Inserting a transaction directly in front of a specific target transaction such that the inserted transaction executes before the target. Most common example of frontrunning is identifying a profitable swap transaction and performing the swap before that transaction to realize the trade.

Backrunning - Inserting a transaction directly behind a specific target transaction such that the inserted transaction executes after the target. Most common example of backrunning is arbitraging price difference across two DEXs after a large swap that affected the price on only one DEX.

MEV through transaction censorship can be extracted by the miner/validator but is harder to identify and measure. We are continuously discovering new forms of MEV everyday as actors discover new ways to profit through innovative means. That being said, not all MEV is deemed harmful to users. For example, backrunning strategies such as arbitrage and liquidations contribute towards optimal price discovery and ensuring protocol credit risk ultimately creating a better experience for the end user. At the end of the day, MEV in some form will always exist, we hope to better understand the attack vectors and minimize the negative externalities as much as possible.

Evolving MEV

The concept of MEV rocketed to attention during the summer of 2020 with the emergence and popularity of DeFi protocols such as Uniswap. Most common MEV opportunities are open to anyone and heavily studied, instilling great competition to extract the available value. So who wins the competition?

To understand how the final block is mined, let’s first look at the software that builds blocks. Geth (Go-Ethereum) is one of the most widely used Ethereum clients and is responsible for the creation and management of Ethereum blockchain nodes. It plays a crucial role in processing and ordering transactions on the Ethereum network. Geth out-of-box ordering algorithm simply prioritizes transactions by gas fees and then randomly orders transactions with the same fees.

A MEV searcher (actor that executes MEV strategies) can therefore pay more gas fees to prioritize their transaction higher than their competition. The upper bound of gas fees is theoretically the max value they can extract through MEV without incurring a loss. When competition is high, searchers compete to get their transaction included at the right position in the block by playing gas games. You do not want to pay too much as you will not profit as much but you also do not want to pay too less as you won’t profit at all. This competition is known as PGAs (Priority Gas Auctions) where searchers start by paying a relatively small gas fee and incrementally increasing their fees to outbid a competitor. PGAs can have negative effects across the network including wasted blockspace through failed or duplicate transactions and spiking gas prices that affect other transactions attempting to acquire block space. So what did we do?

Flashbots Auction Design

Flashbots Auction Design

Flashbots, a research and development company building MEV tools and infrastructure, introduced the Flashbots Auction, a sealed-bid, private and permissioned auction for collections of transactions called bundles. Bundles are a strict ordering of transaction(s) including transaction(s) from an external originator that usually exposes a MEV opportunity and inserted transactions by the searcher that attempt to capture that MEV. Searchers send their bundles to a Relayer (mev-relay) operated by Flashbots that holds an auction for specific opportunities. Flashbots also released a forked version of geth, mev-geth, that connects to the mev-relay and accepts the best bundles of transactions. The auction serves to achieve a more efficient use of blockspace, a more fair value for blockspace, and provide searchers with more control over targeted opportunities.

The Flashbots Auction in practice did achieve its goals to reduce the negative externalities of MEV over the network and bolstered security for miners by creating a marketplace that was economically incentivized to outsource extracting value to specialized searchers.

In 2022, Ethereum migrated from a Proof of Work consensus mechanism to Proof of Stake, where the upcoming dedicated validators are known ahead of time. Along with PoS, Ethereum also is moving towards a new paradigm known as PBS (Proposer-Builder Separation). PBS is a concept that involves separating the roles of "proposing" and "building" blocks within the network. This separation aims to enhance the security, fairness, and decentralization of the blockchain network. While an in-protocol PBS is years in the making, Flashbots released a protocol sidecar auction called MEV-Boost which recreates PBS out-of-protocol.

MEV-Boost Auction Design

MEV-Boost Auction Design

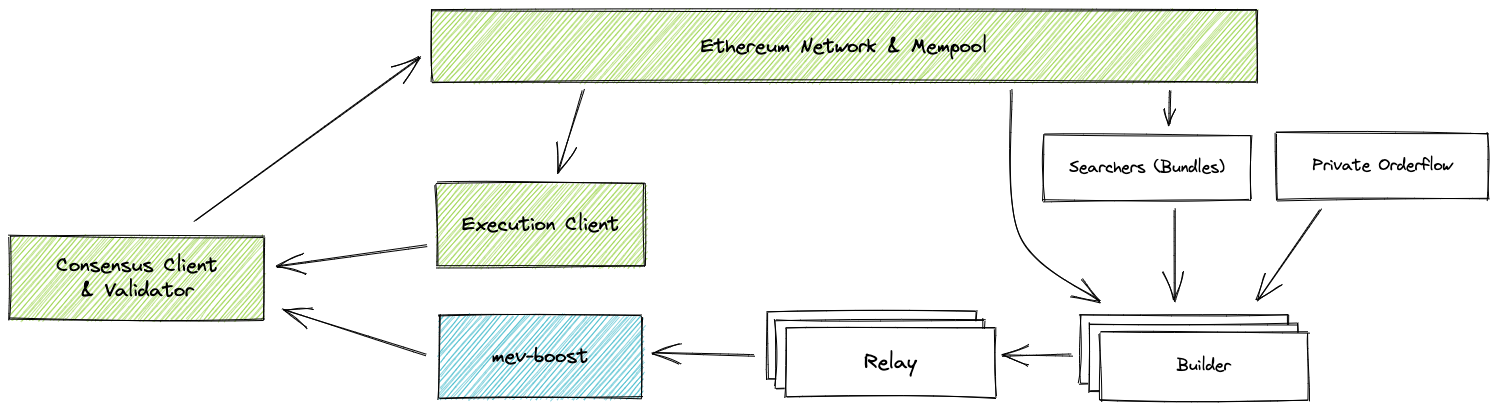

MEV-Boost introduces new entities into the MEV supply chain called block builder and block relays. Block builders are responsible for the “building” of blocks, while validators are responsible for the “proposing” of blocks, imitating PBS. This separation allows for resource intensive demands of block building to be outsourced in an economically secure way. The MEV-Boost auction design steps away from the centralized permissioned Flashbots Auction and allows for an open participation of block builders and block relays. Block relays are similar to the mev-relay in the Flashbots Auction as they are responsible for forwarding only the best block seen in its auction to the validator if it is running a MEV-Boost client. The difference is that block relays are conducting an auction for the entire block rather than specific bundle opportunities.

The block builder is an interesting new addition to the MEV supply chain. Block builders can monitor the mempool for new valid transactions and can operate their own mev-relay to accept searcher bundles. Searchers can still find and extract MEV opportunities at the transaction layer by sending their bundles to block builders. Block builders however have a mix of searcher and validator tools. They can insert their own transactions and therefore be a searcher themselves. They can also reorder and censor transactions to extract value. Block builders compete in the relay auction to produce the most valuable block and ultimately pay the current validator/proposer their bid amount for the rights to use their produced block. The strategies that block builders use to win the MEV-Boost relay auction are still under active research and development. We will cover block building strategies further in a future blog post in this series. At Merkle, we have built robust monitoring tools to collect and analyze data regarding block building to further understand the landscape of the MEV Supply chain. We will next look at some of the brief insights that we have observed.

Relays who?

We collected data from the 6 major block relays through their public data apis. The diagrams above are accumulated metrics over the past 10 days.

Key Takeaways:

There are 3 block relays (Ultrasound, Agnostic, Flashbots) with almost ~100% of the relay market share. This relay diversity is still quite low as 95%+ blocks being built on Ethereum still flow through these 3 relays.

Less than 8% of MEV-Boost winning blocks are seen by more than one block relay. This data tells us that either the winning block is driven by the latency of submitting blocks at the last possible moment such that other relays never see the block, or builders are vertically integrating with relays to optimize their winning probability.

There are a max 84 observed block builders in the past 10 days. (Note: builders are identified by their public key and therefore the same team can have multiple builder keys. But this value is an upper bound)

There is a strong relationship between the number of connected builders participating in the relay auction to the chance the relay sees and forwards the winning block.

There are a max of 2590 observed bids for a specific slot across relays.

Block relays process anywhere from 100-2000 bids per slot auction, with an average between 100-600 bids.

The vast majority of winning blocks are first seen by relays in the last 400ms of the slot auction.

We will leave the analysis by relay up to you!

Buildooors!

Builder Landscape (Rated)

6 seconds left 6 seconds left |  0.5 seconds left 0.5 seconds left |

2 seconds left 2 seconds left |  Auction deadline Auction deadline |

1 second left 1 second left |  3 seconds after 3 seconds after |

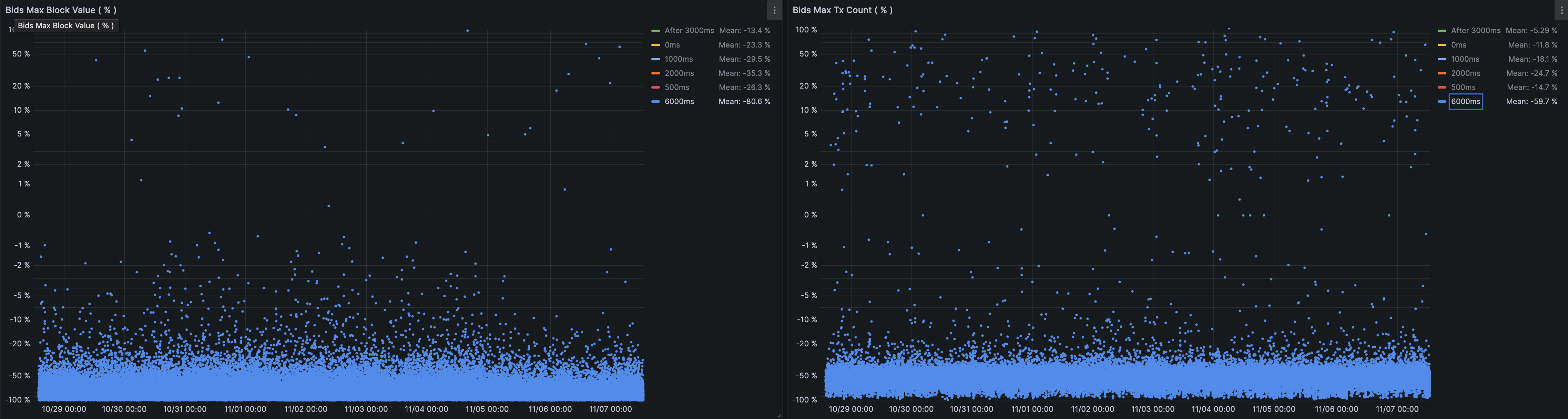

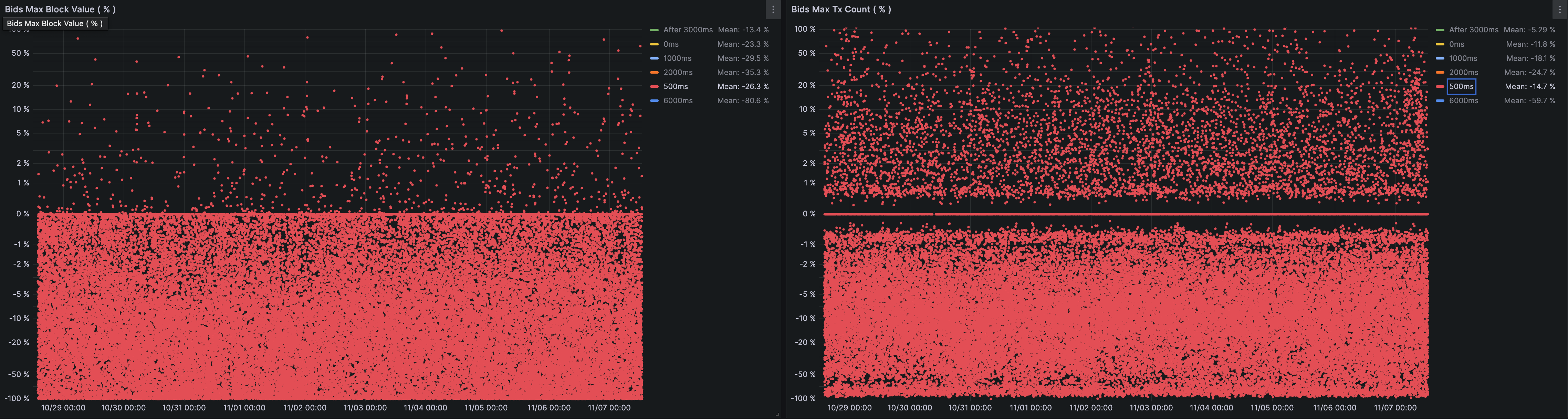

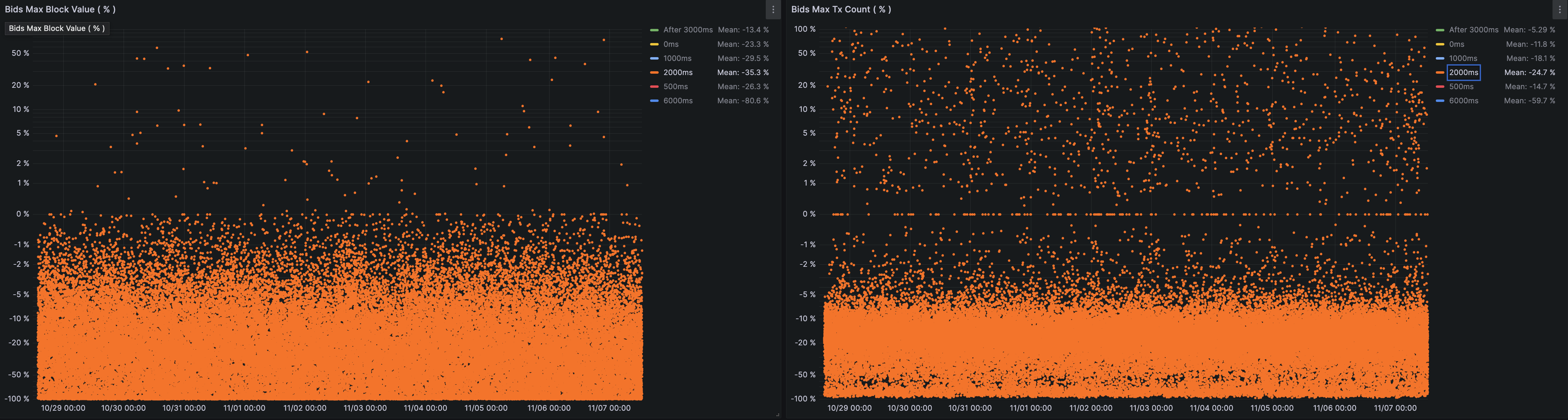

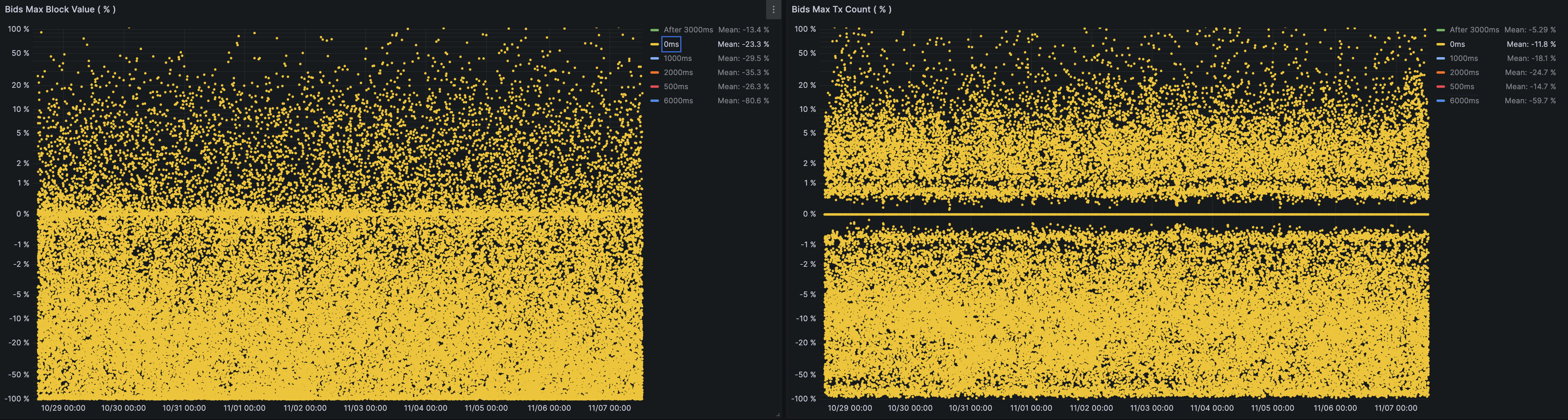

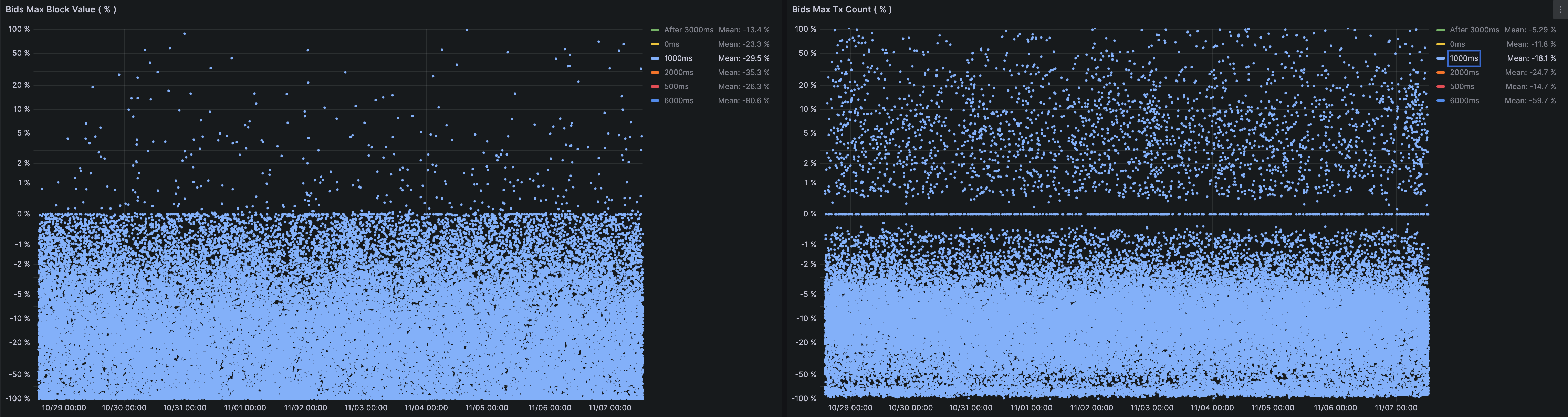

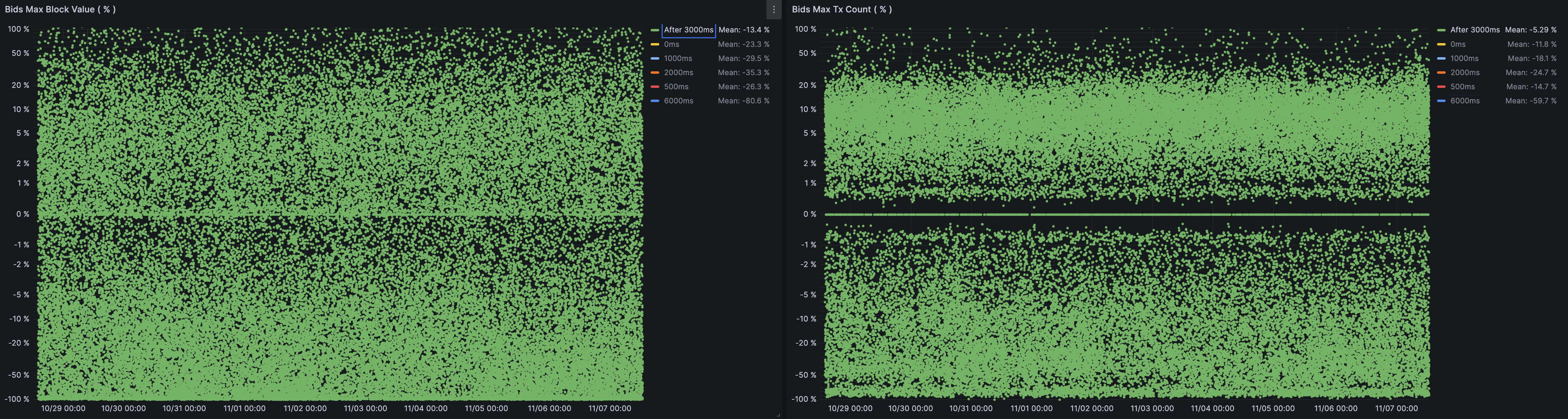

Builder Bid Auction By Time Delta to Slot Auction Deadline (Merkle). Each diagram contains the max block value (left) and max transaction count (right) seen across all relays at the specific time delta from the end of the auction.

We collected data from the 13 major block builders through the relay public data apis. The diagrams above are accumulated metrics over the past 10 days.

Key Takeaways:

The top 3 block builders control 77% of the builder market share and the top 5 control almost 95%. This builder diversity is also still quite low. Although compared to relays there are far more active block builders that are not as competitive.

Builders rsync-builder and beaverbuild tend to create high value blocks in certain occasions while their overall market share is unaffected. This leads us to infer that these builders capture value through CEX-DEX arbitrage strategies when market volatility increases.

Builder0x69 is the most well-known builder to be neutral, meaning they do not run internal MEV strategies and therefore outsource MEV extraction completely to searchers.

Builders tend to focus on their niche, and when the opportunity arises are able to out compete the market.

The last 1 second of the slot auction generally shows the greatest change in the fair value of the block in the relay auction, both measured by block value and number of transactions included in the block.

Transaction count differences by time in the slot auction are more pronounced than block value. This can mean that builders that wait as long as possible are able to collect more available transactions and therefore create a higher value block.

Conclusion

MEV has undergone a great evolution over the past few years. We have greatly improved on MEV extracting capabilities, mitigation measures, monitoring and security tooling, etc. Today we focus on the emergence of block builders and their role, strategies, and adaptations in the years to come. We hope to dive into the various aspects of block builders in upcoming blog posts in this series, including their business models, strategies, competitive landscape, and performance.

If you have any questions or want to collaborate on any new ideas, please reach out on twitter or discord!