- Published on

Rug Pull Analytics on Ethereum tokens

- Authors

- Name

- merkle

- @merkle_mev

As we are preparing a brand new trading terminal, we've been taking a look at some interesting aspects of token trading.

Part 1: Our AI endeavours

Embarking on our AI journey, we were fueled by grand ambitions. Building a token trading bot, a concept as compelling as it is complex.

Imagine entrusting the intricate decisions of token selection, along with the nuances of timing and risk analysis, to an automated entity. Our exploration led us to an array of models, like Random Forest and XGBoost, alongside deep learning models such as LSTM models. Our quest for the ideal model culminated with the Proximal Policy Optimization (PPO) model, which is a blend of transformer architecture and Reinforcement Learning (RL). PPO stands out by its method of navigating the delicate balance within a specified policy range (in our case, when to buy and sell a token). In pursuit of this, we delved into open-source resources, notably Stable Baselines from OpenAI and an example of Deep RL by AI4Finance.

As we prepared our data to fit the model’s inputs, we encountered the murky waters of crypto trading's achilles heel: rug pulls. This was in stark contrast with the potential new tokens hold. The tokens with the most upside are often the ones the most recently released. Meaning if we solve the token rug pull classification, this would be a huge step forward in assisting the trading bot.

We rolled up our sleeves and dove into this head first. Our analytical framework for understanding rug pulls segmented into three broad categories: token metadata (encompassing market cap, liquidity, price…), ownership distribution, and the intricacies of smart contracts.

Part 2: A simple token analysis

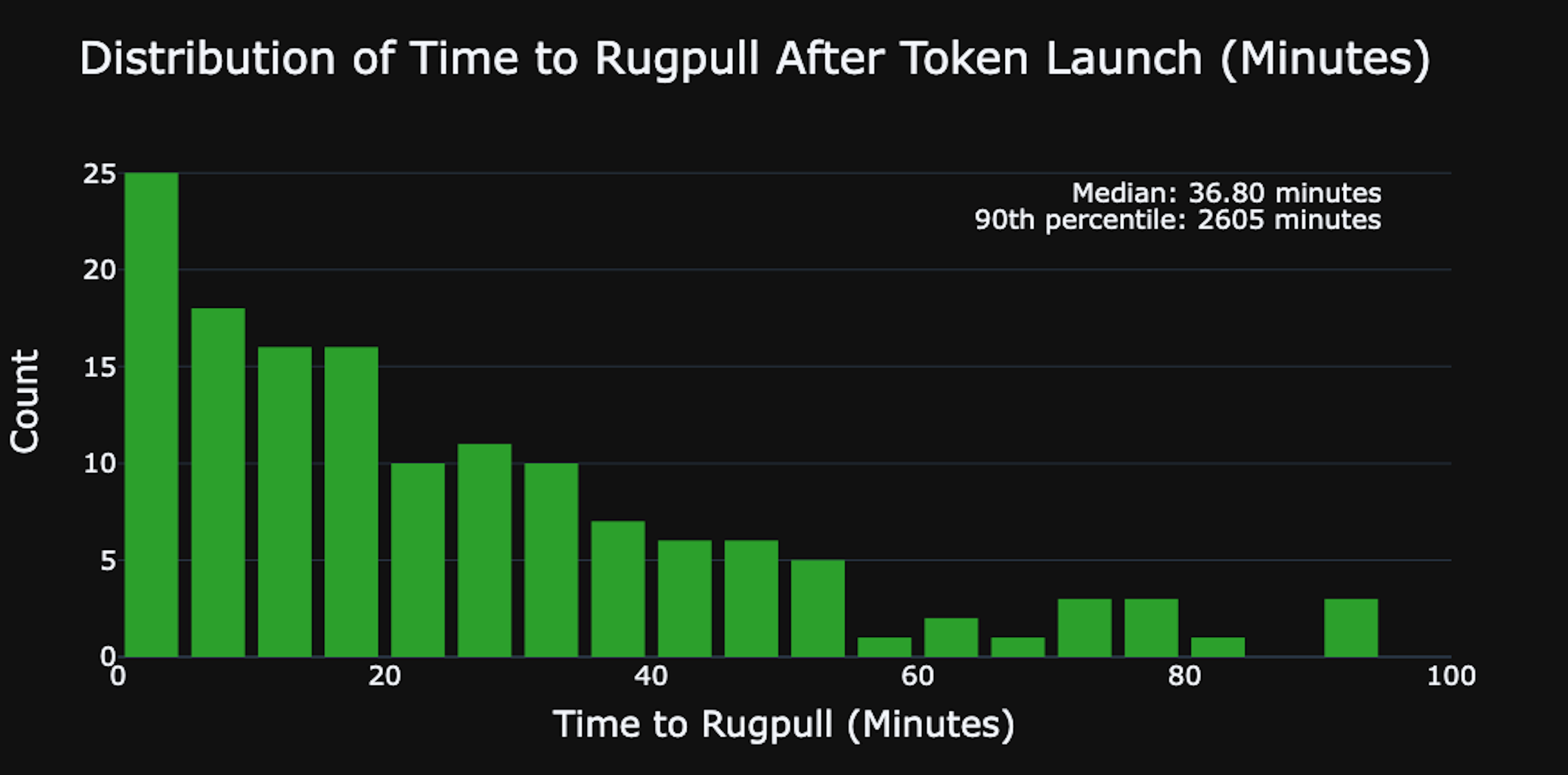

At Merkle, we are deeply committed to empowering crypto traders with the knowledge and tools they need to navigate the market effectively. Our recent analytics dive into several rug pulls on major blockchain networks has revealed some intriguing findings. Utilizing Merkle’s RPC, we accessed 15 days' worth of transactions across Ethereum, Polygon, and BSC chains. Given Ethereum's higher incidence of rug pulls, our focus was primarily on this chain. Our analysis reveals a startling pattern in the lifespan of tokens. A staggering 90% of tokens experience a rug pull within the first 2 days of creation. The median time to rug pull is notably short, at just 36 minutes, highlighting the first half-hour as a high-risk period for new tokens. After this initial phase, while the risk decreases, it still persists significantly over an extended period.

Ethereum Gains and Losses

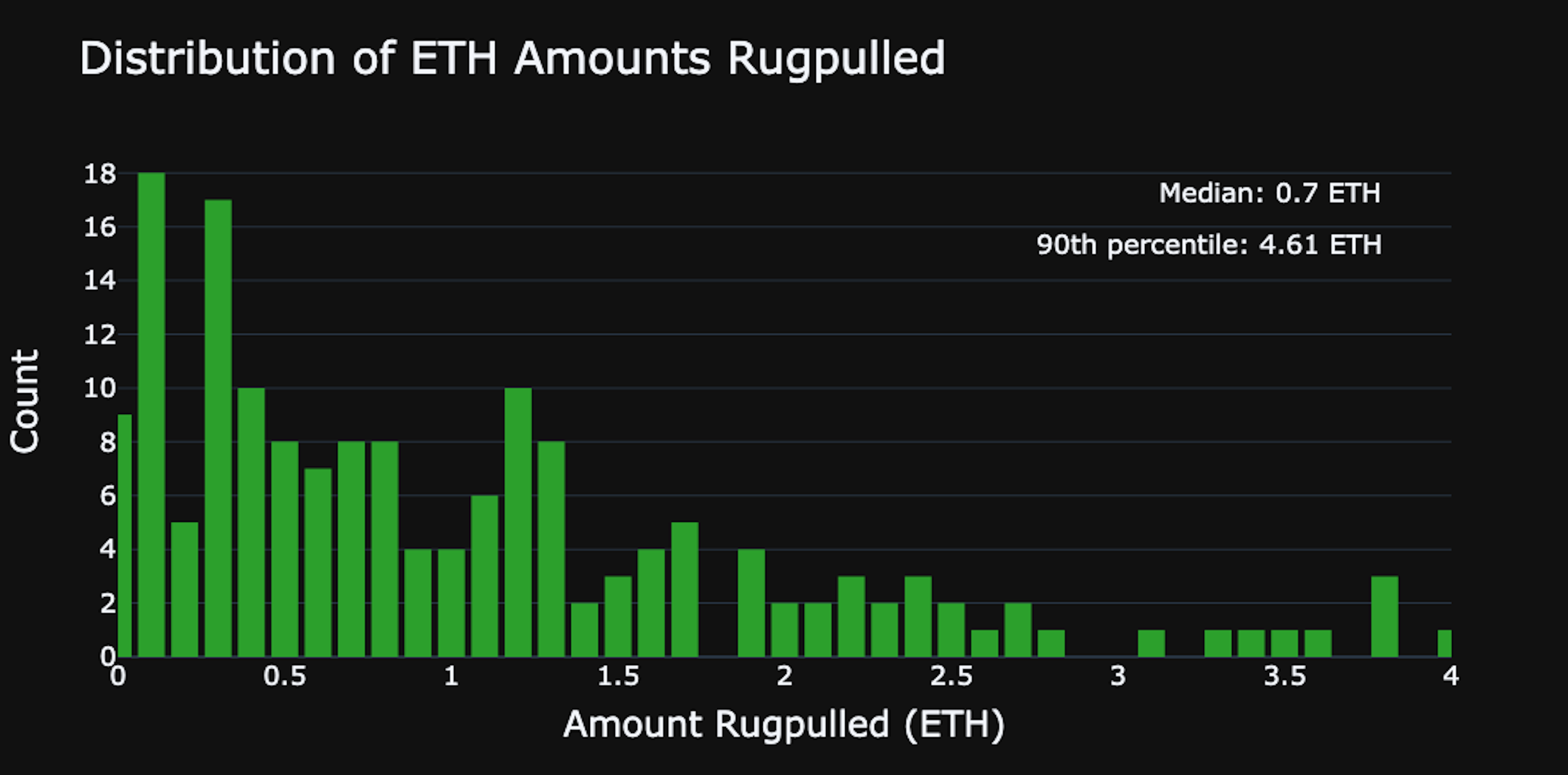

In examining the Ethereum (ETH) amounts amassed prior to rug pulls, we observed a median investment figure of 0.7 ETH, with the 90th percentile reaching around 4.6 ETH. This suggests a modest but non-negligible financial impact on investors per incident.

Investment Velocity and Rug Pull Timing

We hypothesized a correlation between the rate of investment in a token and the timing of its subsequent rug pull. The higher the rate of investment, the more incentivized investors are to wait before withdrawing their investments and consequently the longer the token developer would wait before rug pulling. Our findings yielded a Pearson Coefficient of 0.247 with a P-value of 0.000188, indicating a weak but direct correlation. Rapid investment in a token appears to slightly delay the likelihood of a rug pull, as opposed to tokens with slower investment rates.

HH Index and Its Implications

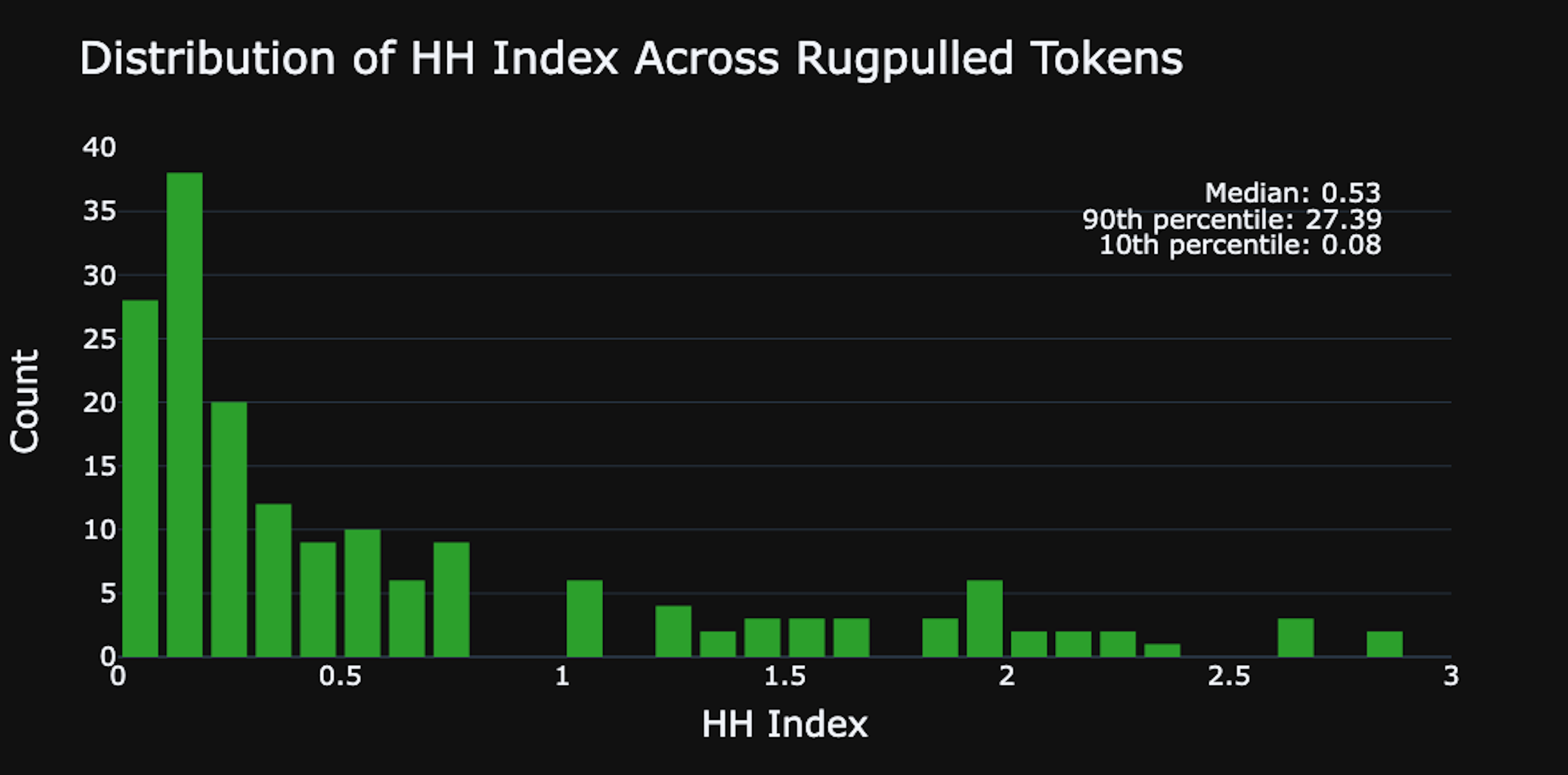

Analyzing the Herfindahl-Hirschman Index (HHI) for these tokens offered another dimension to our study. Despite a median HHI of 0.53, which typically suggests a healthy ownership distribution, our findings indicate that this metric alone does not reliably predict the likelihood of a rug pull. The implication here is that many addresses, despite appearing originating from different people, might be under the control of a few entities or even only the token owner.

Contrary to the common perception of catastrophic financial losses due to rug pulls, our analysis suggests that the actual amount of money lost is relatively small when considered in the context of the entire Ethereum trading volume. While rug pulls undeniably pose a risk, especially in the early hours of a token's life, they represent a relatively minor fraction of the total number of transactions and amount invested on the Ethereum network. This insight should not diminish the need for vigilance but rather contextualize the risk rug pulls pose in the broader landscape of Ethereum trading.